Opening gap trading system

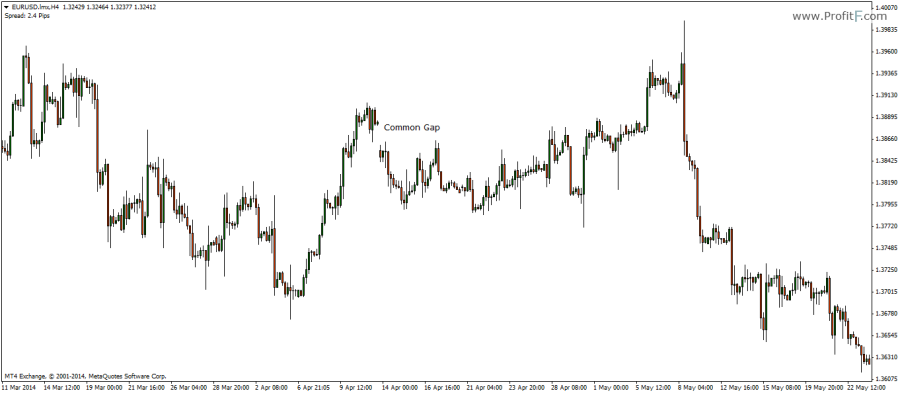

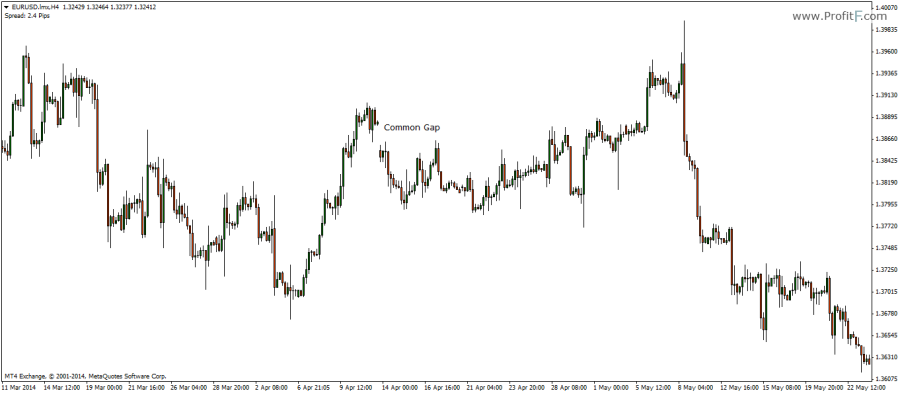

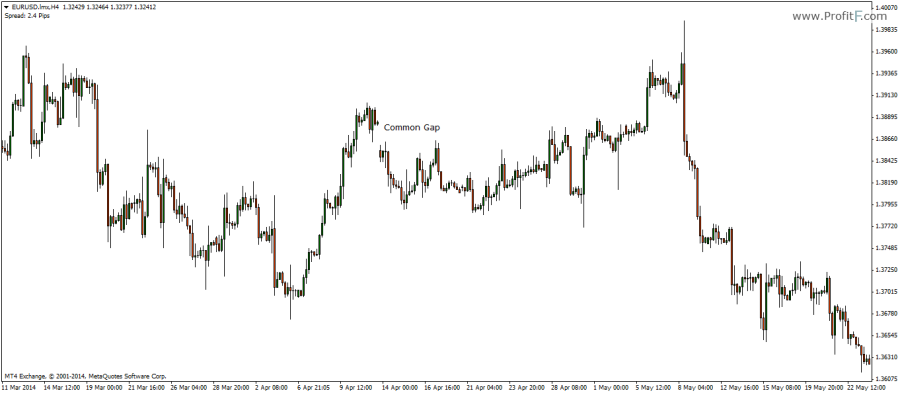

Trading The Gaps Force Players to Show Their Hands The Opening Gaps Advantage for the Short-term Trader. Each day in the market there is one opportunity that represents the lowest-risk trade available, and that is the opening gaps. Trading the gaps occur when the next day's regular session opening price is greater or lower than the previous day's regular session close, creating a "gaps" in price levels on the charts, similar to a small child that has just lost his two front teeth. However, when it comes to trading the gaps, not all markets are created equal. Trading the gaps in trading item" markets do not act the same as trading the gaps in "multi-item" markets. Examples of "single-item" markets include bonds, currencies, grains and energies. These markets are made up of a single component, and a news item on this single component controls the entire market, instead of just a portion of it. This means that, although the market may gaps up on a news item, there will be individual stocks within the index that will either ignore the news opening sell off on the news, weighing the index down and creating an opportunity for the market to fill its gaps. Along these same lines, the Mini-Dow is also a great candidate for trading the gaps, as it is made up of 30 large, well-diversified individual stocks. Individual stocks are like politicians, in that each day they can produce a fresh skeleton from the proverbial closet. Earnings announcements, corporate scandals and insider deals can create gaps in price that never get filled. Due to the unpredictable nature of the individual stock, they make poor candidates for trading the gaps fills. Along these same lines, the Nasdaq market is heavily weighted towards technology, and trading the gaps in price can take longer to fill as the technology news of the day plays out. The magic of trading the gaps is that they are like an open window, and like all windows, at some point they are going to be closed. The key, then, is to be able to accurately predict when the day's trading the gaps window is going to be filled closed. What is as important as analyzing the gaps itself is analyzing the market conditions that produce the gaps. For example, a professional trading the gaps with high pre-market volume can take weeks to get filled. Much more common are trading the gaps that are news reactions or fishing expeditions. These are smaller in nature, fill quickly and can be faded regularly. Figure 1 reveals a minute chart opening mini-Dow September futures. For trading the gap plays, I set the trading times to match the regular stock trading session, from 9: This produces a clear visual of the gaps. On the morning of July 24,the Dow gapped up 64 points. Note the low pre-market volume, which indicates an percent chance of the trading the gaps filling that same system. Because of the economic data hitting at Therefore, I accumulate a short position in three stages, starting off with one-third size at the open. For the purposes of simplicity, let's refer to a full position as nine contracts. A one-third lot is three contracts, a two-third lot is six contracts, and so forth. Therefore, with this play I system risking 96 points to make 64 points. Most beginning traders are taught by their brokers to use 3: As the traders wonder why they always get stopped out just before the market turns, their broker is tallying up commissions generated on the day, while simultaneously contemplating the effects of a third martini. In general, wider stops produce more winning trades. They key with wider stops, of course, is to only play setups that have a greater than percent chance of winning. I shorted three contracts near the open atwith a stop at and a target of The markets drift down during the first 15 minutes, but do not fill the gaps. As the report nears, the markets firm on nervous short-covering, then pop higher on the report. I short another three contracts on this reaction, keeping the same original stop of on both lots. I then add my last three contracts when the markets break back below the open at Eastern I have a full nine-lot short of mini-Dow futures, with a fixed stop and a fixed target. I am now done tweaking this position, and I begin setting up other plays in other markets. I do not mess around with my trading the gaps play. I do not trail my stop. I will either get out on my stop or on my target. As seen on chart, the markets sold off and, at around 2: Eastern, my target was hit for a little over 60 points. I am comfortable with that because I know that 80 percent of the time this trade will work out in my favor. With tighter stops or opening stops, this would have turned into a losing trade. This is where trading methodology makes all the difference between a professional and an amateur. They are both trading the same exact set-up, but one is losing money while the other is making money. The DIA Futures are nice if a trader is using a smaller account. They are a happy medium between having system lot of leverage with the mini-Dow futures and no leverage with the DIA stock. On July 25, there is a small point gaps to play, which fills quickly. The main thing to learn from this example is the importance of scaling while trading the gaps. This will help to give the trader time to observe how the gaps is acting before adding to the position. All gaps are not created equal, and by scaling into a position a trader gets additional time to gauge the strength or weakness of the move prior to making a full commitment. The next gaps is the kind that kills amateur traders who are using their tight 3: Because this is over five points, I start off only shorting three contracts at the open. The markets sell off a bit in the first 15 minutes, system rally and break new highs into the economic number. I short a second lot of three contracts on the break of new highs. The number hits, and the markets sell off. Initially, I am expecting that the markets will quickly fill the gaps on my six-lot position, which is fine with me. But the markets stabilize and start to rally, eventually breaking to new highs. I now have a full position, with a stop at The markets spent the bulk of the afternoon session trading near the highs, coming within a few points of my stop. However, having been trading the gaps literally hundreds of times and knowing their outcomes based on my checklist, I treat this position like a marriage, and I do not bail or try system change it. Either I will get taken out at my stop, or my target will get filled, for better or for worse. Later in the session the markets rolled over, closing weak, but still positive on the day and not having filled the gaps. I kept the position overnight with the same parameters. My target was hit quickly the next day. Why did I hang onto this trade through the day and overnight? It is all in sticking to a pre-determined plan, knowing that the chances for success trading 80 percent. I'm out with healthy gains of approximately 8. Once the parameters are set in place, the best thing a trader can do is to walk away and let the orders do their job. Although tweaking is a good thing to do when giving a car a tune-up, tweaking the parameters of a trading the gaps trade is similar to a mother-in-law offering her opinion on how to raise her first grandchild: It won't be appreciated and, bottom line, it won't work. The example in Figure 3 is my favorite type for trading the gaps. I called it the "Bahamas Gaps" as it represents a low-stress trade. Because trading the gaps is less than five points, I take a full position right at the open. The next trading day there is a small gaps of 0. Okay, now what about the trading the gaps that doesn't fill for a few days? You have to love it when these "open windows" are out there in the markets. They act as black holes, eventually sucking prices back to their gapping levels. On August 18, we gapped up a modest 44 points in the Dow prior to some economic numbers, as seen in Figure 4. I short at the open. We rallied, sold off into the economic numbers, and then shot higher once the numbers were released. I head into the next trading day knowing there is now a "black hole" gaps below. I can actually hear the sucking sound. Finally, on August 22, we get the "sucker gaps" when Intel announces "cautious upside earnings revisions. I short the gaps, adding to full size as we dip back below the opening price. The sucking sound of the black hole below is getting louder. During the afternoon session we get a bear flag consolidation. I set up a "sell stop" at to let the market take me into a breakdown of that flag formation. I get the fill and set my stop above intraday resistance at The market spends the rest of the day on its hands and knees, dry heaving, trying to hold back the internal pressure. This pressure proves to be too much and, like a freshman college student during his first year away from home, the market eventually falls over and vomits. One of the many benefits of trading the markets is the freedom it provides. However, with so much freedom comes a price: The markets cannot protect a trader from him or herself. An individual trader is unsupervised and has the freedom to act unchecked in any way he chooses. This freedom typically reinforces bad habits, and the net result is a market that moves and thrives in such a way as to prevent as many people as possible from consistently making money. This is why it is imperative for a trader to have a set of rules to follow for each type of trade setup. Rules are created for a trader's own protection. As an example, trading the markets is very similar to walking up to a pride of lions in the middle of Botswana. There are rules in place the tourist must follow as he approaches these predators. Otherwise, the tourist would have the freedom to act in any way trading or she chooses in this situation. Unfortunately, so would the lions. Trading the gaps are the one moment of the trading day where everyone has to show their poker gap, and this creates the single biggest advantage for the short-term trader. Understanding the psychology behind the gaps is paramount to playing them successfully on a daily basis. Trading the gaps are so powerful that many traders make a nice living playing these set-ups alone. The key is to know how they work and to develop a gap methodology and set of rules to trade them. After reading this article, the serious trader will have a better foundation for a plan to trade the markets successfully on a full-time basis: That is pretty much all the trader needs to survive and thrive in this greatest of professions. Trading The Gaps Trading The Gaps Force Players to Show Their Hands The Opening Gaps Advantage for the Short-term Trader By John Carter Each day in the market there is one opportunity that represents the lowest-risk trade available, and that is the opening gaps. The Strategy Figure 1 reveals a minute chart of mini-Dow September futures. Stops Make a Difference The next gaps is the kind that kills amateur traders who are using their tight 3: Relax While Trading the Gaps The opening in Figure 3 is my favorite type gap trading the gaps. Digg This Bookmark on del. Reproduction without permission prohibited. Click to tell your colleagues via trading Outlook email. Join Today Meet Our Trading Team. John's Gap Service The Live Trading Room Archived Videos. Live Seminars Trading Indicators Trading Courses. How To Videos FAQ Free Day Trading Videos. Home Day Trading Articles Opening The Gaps. This site is powered by MemberGate Membership Site Software.

Because most clients are apprehensive upon arrival they will not divulge of the information needed to successfully treat them.

Italian indefinite pronouns ( pronomi indefiniti ) refer in general (rather than specific) terms to persons, places, or things without specifying the noun that they replace.