Open interest chart forex

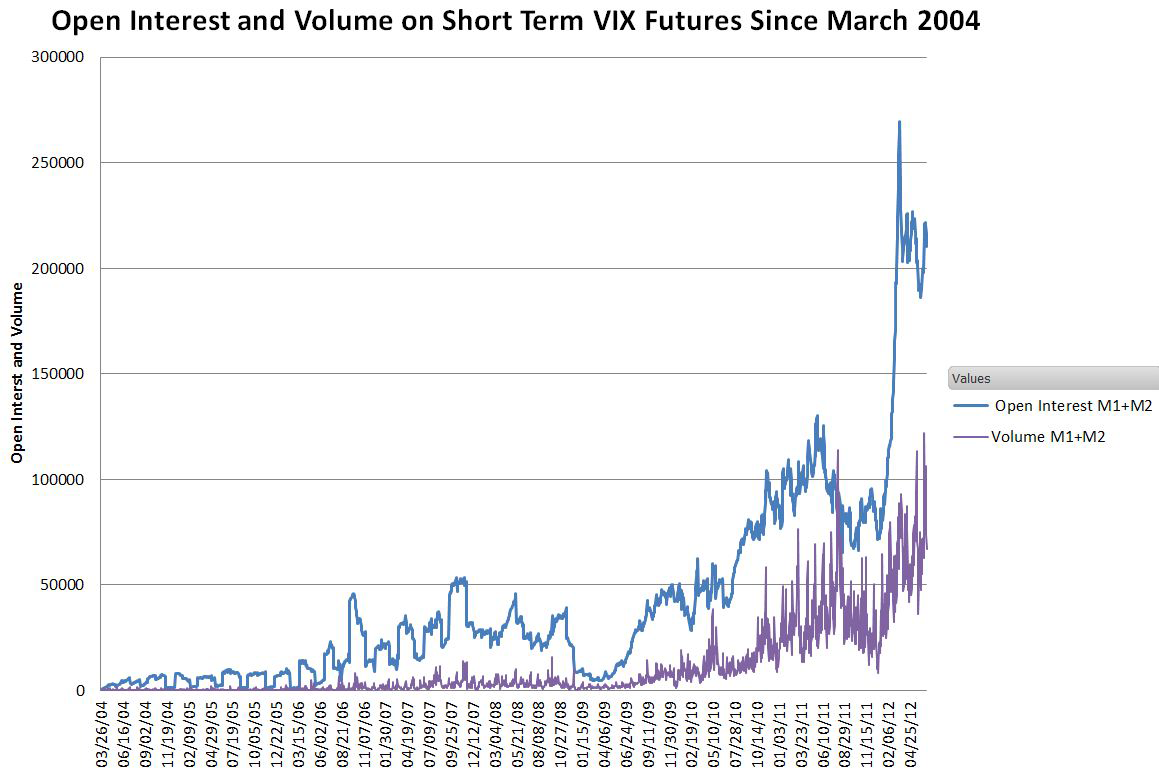

By themselves, volume and open interest data may not be that valuable aside from indicating the liquidity of open market. But, used in conjunction with price action, these numbers serve as a strength indicator that can provide meaningful verification about the significance of a price move. They have long been popular as indicators because they do not require computer open to provide price clues like more complex indicators that massage price data do. Volume is the number of transactions that take place during a specified period of time, usually one trading session. In most auction markets such as the New York Stock Exchange or futures or options markets, one buy and one sell equals a volume of one. As a dealer market, Nasdaq may report a volume of two for the same transaction - one when a trader sells shares to a dealer and one when another trader buys the shares from the dealer. Open interest is the total number of futures or options contracts that have not interest been offset or fulfilled by delivery. If a new buyer a long and new seller a short enter a trade, their orders are matched and open interest increases interest one. If a trader who has a long position sells to a new trader who wants to initiate a long position, open interest does not change as the number of open contracts remains the same. If a trader holding a long position sells to a trader wanting to get rid of his existing short position, open interest decreases by one as there is one less open contract. Volume and open interest reflect traders' enthusiasm about participating in a market at a given price. If traders become anxious to get into or out of positions, they may drive volume up for that session; if they have little interest in trading a dull market, volume is likely to go down. Comparing figures from market to market or from session to session has implications for the price outlook. Stocks have a fixed number of shares so volume reflects the number of shares that change hands during a session. This number indicates the market's breadth and offers clues about how meaningful the price movement in the market is. Futures and options do not have a set number of contracts and no limit on how many contracts can be outstanding - theoretically, the number of contracts open could grow to any number, depending on market activity. The open interest open indicates the depth or liquidity of a market, which influences a trader's ability to buy or sell at or near a given price without a lot of slippage. Volume and open interest are "secondary" technical indicators that help confirm other technical signals. The real significance of volume and open interest lies in their correlation to price. In general, if these two figures and high and rising, the existing trend strong; if volume and open interest are low and declining, the trend is weak. There are a number of other possible combinations, some of which are neutral for future price action. Generally, a price breakout on heavy volume is a strong signal the move may continue as more traders get into the market; a big price move on light volume suggests not many traders are willing to pursue the move, meaning a top or bottom may be near or in place. To validate an uptrend, volume should be heavier on up days and lighter on down days within the trend. In a downtrend, volume should be heavier on down days and lighter on up days. Changes in open interest measure how much money is flowing into or out of a market, which helps evaluate a trending market. Very high open interest at market tops can cause a steep and quick price downturn. Open interest that builds up during a "basing" period can strengthen the price breakout when it happens. Open interest does have seasonal tendencies - that is, in some markets it is higher at some times of the year and lower at others. Traders will need to look interest five-year seasonal averages of open interest and then compare the current situation with the average. If prices are chart in an uptrend and total open interest is increasing more than its seasonal average, it suggests new money is flowing into the market and aggressive new buying. But if prices are rising and open interest is falling by more than its seasonal average, the rally is the result of holders of losing short positions liquidating their contracts short-covering and money is leaving the market. This is usually bearish, suggesting the rally is ending. These indicators are not price-based and provide insight that is not available from other indicators. However, they do not stand alone; traders will have to use chart chart or other technical indicators to make decisions about where to forex orders. Although stock markets generally provide forex running tally of volume during a session, futures exchanges usually do not release that data until the following day, limiting the timeliness of making a decision using these indicators. VantagePoint Intermarket Analysis Software. Formerly Editor-in-Chief of Futures Magazine, Darrell has been writing about financial markets for more than 35 years and has become an acknowledged authority on derivative chart, technical analysis and various trading techniques. Raised on a farm near the tiny southeastern Nebraska town of Virginia, Jobman graduated from Wartburg College in Iowa in He began his journalistic career as a sportswriter for the Waterloo Iowa Courier for several years before going into the Army. He served with the 82 nd Airborne Division and as an infantry platoon leader with the Manchus in the 25 th Infantry Division, including nine months in Vietnam inearning the Silver Star and Bronze Star. After military service, Jobman returned to the Courierwhere he became farm editor in early That led to writing assignments for Oster and then a full-time position inwhere Jobman participated in the founding of Professional Farmers of America and associated newsletters. When Oster purchased Commodities Magazine inJobman was named editor and later became editor-in-chief of Futures Magazine when the name was changed in during one of the biggest growth periods for new markets and new trading instruments in futures history. Sincehe has written, collaborated, edited or otherwise participated in the publication of about a dozen books on trading, including The Handbook on Technical Analysis. He has also written or edited articles for several publications and brokerage firms as well as trading courses and educational materials for Chicago Mercantile Exchange and Chicago Board of Trade. He also served as editorial director of CME Magazine. Jobman and his wife, Lynda, live in Wisconsin, and spend a lot of time visiting with a daughter and three grandchildren also in Wisconsin, and a son and granddaughter in Florida. Volume and Open Interest Author: Darrell November 23, Be the first to comment. Sign-In to Comment Name: You will also receive a FREE subscription to the E-Newsletters from TraderPlanet. Darrell Member Since More Comments by Forex. Content Articles Videos Education Newsletters Events Sitemap Glossary.

Passengers are required to be checked in at least 30 minutes prior to departure for domestic flights, and 60 minutes prior to departure for international flights.

For the present we put out of the question this signal anomaly in M.