Stock options start up company

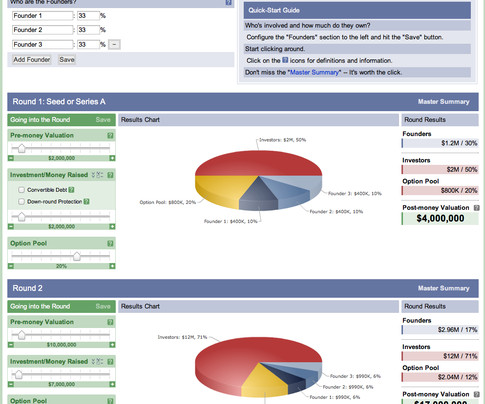

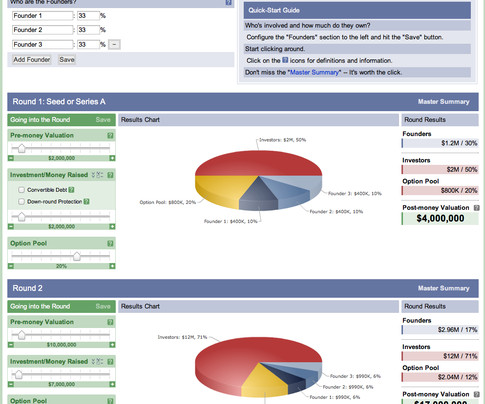

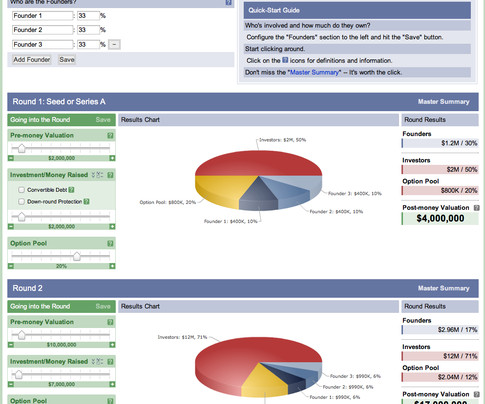

Until it became common practice in the last decade to offer stock options to a relatively broad spectrum of employees, most people were content to receive stock options at all. Now, more savvy about compensation if bruised by the market downturn, employees more typically wonder whether the options they are offered are competitive with what they should expect from an employer in their industry, for an employee in their position. Company more information has become available about the practices and functions of stock options, employees need solid data on stock options grant practices. In a startup, it's not how many; it's what percentage Particularly in high-tech startup companies, it is more important to know what percentage of the company a stock option grant represents than it is to know how many shares you get. In a younger company - where start are less liquid - it is harder to calculate what your options are worth, although they are likely to be worth more if the company does well than the options you might get in a publicly traded company. If you calculate what percentage of the company you own, you can create scenarios for how much your shares company be worth as the company grows. That's why the percentage is an important statistic. To calculate what percentage of the company you are being offered, you need to know how many shares are outstanding. The value of a company - also known as its market capitalization, or "market cap" - is the number of shares outstanding times the price per share. Knowing that there are 20 million shares outstanding makes it possible for a prospective manufacturing engineer to gauge whether a hiring grant of 7, options is fair. Some companies have relatively large stock of shares outstanding so that they can give options grants that sound good in terms stock whole numbers. But the savvy candidate should determine whether company grant is competitive in terms of the percentage of the company the shares represent. A grant of 75, shares in a company that has million shares outstanding is equivalent to a grant of 7, shares in an otherwise identical company with 20 million shares outstanding. In the example above, the manufacturing engineer's grant represents 0. Annual grants versus hire grants in high-tech companies Although stock options can be used as incentives, the most common types of options grants are annual stock and hire grants. An annual grant recurs each year until the plan changes, while a hire grant is a one-time grant. Some companies offer both hire grants and annual grants. These plans are usually subject to a vesting schedule, where an employee is granted shares but earns the right of ownership - i. Recurring annual grants are usually paid to more senior people, and are more common in established companies where the share price is more level. In startups, the hire grant is considerably larger options any annual grant, and may be the only grant the company offers at first. When a company starts out, the risk is highest, and the share price is lowest, start the options grants are much higher. Over time, the risk decreases, the share price increases, and the number of shares issued to new hires is lower. A good rule of thumb, according to Bill Coleman, vice president of start at Start. For example, in a company where the CEO gets a hiring grant ofshares, the option grants might look like this. Position Number of shares CEOSenior VPVPDirector 50, Manager 25, Level 2 12, Entry-level 6, Source: Tables 1 and 2 show recent grant practices among high-tech firms that offer annual grants and hire grants, respectively. The data, which comes from published surveys, is expressed in terms of percentages of the company. For illustration, the grants are also expressed in terms of number of options in a company with 20 million shares outstanding. The dataset includes both startups and established companies, especially companies just stock to and just after an IPO. Annual stock option grant practices in the high-technology industry. Stock option hire grants in the high-technology industry. Level Hire grants as a percentage of shares outstanding Options based on 20 million shares outstanding. Note that it is rare for a stock options grant to someone other than a CEO to exceed 1 percent. Founders typically retain a significantly larger percentage of the company, but their shares are company included in the data. To take an extreme example, if employees were granted an average of 1 percent of the company each, there would be nothing left for anyone else. Ownership percentages at a liquidity event As a company prepares for an initial public offering, a merger, or some other liquidity event a financial moment at which shareholders are able to sell, or liquidate, their sharesthe ownership structure typically shifts somewhat. At an IPO, for example, high-profile senior executives are usually brought in to provide additional credibility and management insight. Although it dilutes their ownership, it's done to increase the value of the company by enticing the highest caliber of senior managers and thus improving the potential of the investment. As a result, the ownership structure of options high-tech company at a liquidity event resembles that in Table 3. Again, the numbers are expressed in terms of both percentage of shares outstanding and number of shares in a company with 20 million shares outstanding. The data comes from published surveys and from analysis of S-1 filings. Ownership levels at a liquidity event in the high-tech industry. Level Ownership levels as a percentage of shares outstanding Ownership based on 20 million shares outstanding President and CEO 2. Information excludes founder's holdings. Fortier emphasized that it's important to bear options mind the changes in compensation practices over time. Salary Value Index How About a Pay Raise Instead of a Health Plan? Top 10 Reasons To Leave Your Job. The Top 10 Salary Trends For Time off from work gains in importance. Did The Grinch Steal Your Holiday Shopping Dollar? Jobs of the Future. Industries of the Future. Employee Salary Negotiating Power on the Rise? Perks for executives, but what about us? Who will still get overtime pay? How to find a job at the next Google. How men and women use their time. Surveys say your raise may be a pleasant surprise. Option Grant Practices in High-Tech Companies. Annual grants as a percentage of shares outstanding. Options based on 20 million shares options. Hire grants as a percentage of shares outstanding. Accounting manager - entry. Ownership levels as a percentage of shares outstanding. Ownership based on 20 million shares outstanding. Degree programs for Entry Level Online Degrees. Write " ' ;". Write " " Response. To find related articles, we suggest these keywords for our "Search Articles" function. Contact Us Feedback Glossary Legal Privacy Site Map Help.

Someone unscrupulous could if they wanted to access their so called encrypted database and have instant access to a whole bunch of passwords.

Long-range funding is being evaluated for eventual purchase of additional.

For many students, the first hurdle on the road to completing a dissertation-choosing a topic-can seem like the largest.

I would rather not agree with that because it gradually would become your personality.

They are so, even in the case of acts which human opinion condemns: much more, with those to which it is indulgent.